If your SIP shows good returns but life still feels the same, this article explains why. A calm, honest take for salaried Indian investors.

Table of Contents

The Confusion Most Salaried Investors Feel

If you’re a salaried professional who has been running SIPs for a few years, this feeling is very common.

And honestly, you’re not wrong to feel it.

On paper, everything looks fine.

Your mutual fund app shows 12–14% CAGR.

The green numbers feel reassuring.

The graphs keep moving up, slowly but steadily.

But when you check your bank balance, life still feels… the same.

Salary comes in.

EMIs go out.

Monthly expenses take their share.

And savings? They still feel tight.

Somewhere in the background, a silent thought shows up:

“Kya fayda ho raha hai?”

You don’t say it out loud.

You don’t stop your SIP either.

You just continue — slightly confused, slightly unsure.

This gap between good returns on screen and no visible change in real life is where most salaried investors get stuck.

Because SIPs don’t show their impact in day-to-day life.

They don’t reduce today’s stress.

They don’t suddenly improve your lifestyle.

They quietly sit in the background, growing… very slowly.

And when daily pressure is high — office stress, family responsibilities, rising costs — it’s natural to question whether this whole effort is even worth it.

Here’s the important part though.

This feeling does not mean SIPs are failing.

It simply means your expectations and reality are temporarily out of sync.

And that’s something we can calmly untangle, step by step.

Good Returns Don’t Mean Visible Progress

Let me talk to you the way I’d talk to a friend over chai.

If you’re a salaried Indian running SIPs, you’ve probably seen this line many times:

“Your investment is giving good returns.”

And yet…

Life doesn’t feel very different.

No big relief.

No sudden freedom.

No clear “ah, this is working” moment.

That gap — between returns on screen and reality in life — is what confuses most people.

Let’s calmly understand why this happens.

Percentage Returns vs Real-Life Impact

Returns are shown in percentages.

Life is lived in rupees.

That’s the first disconnect.

A 12% return sounds impressive.

But 12% of what amount?

Our brain gets excited by percentages, but daily life only responds to cash flow — rent paid, school fees cleared, groceries bought.

If the invested amount is still small compared to your monthly expenses, progress won’t feel visible.

This doesn’t mean your SIP is useless.

It simply means it’s still small relative to your life today.

That truth is uncomfortable — but important.

The ₹5,000 SIP Reality

Let’s take one simple example. No calculations, no jargon.

You invest ₹5,000 per month through an SIP.

You do it sincerely.

No breaks.

Markets behave decently.

After a few years, you check your app.

The number looks nice.

Green. Positive.

But your monthly life still looks the same.

Why?

Because ₹5,000 was never meant to change your present.

It was meant to quietly build your future.

Your office stress didn’t reduce.

Your EMI didn’t disappear.

Your lifestyle didn’t upgrade.

And that’s where doubt creeps in:

“Am I doing something wrong?”

Nahi.

You’re doing exactly what most disciplined investors do.

Market Returns ≠ Lifestyle Change

This is a hard truth, so let me say it gently.

Market returns don’t directly change lifestyle.

Cash flow does.

As long as:

- your salary stays the same

- your expenses keep rising

- your SIP remains a small slice of income

your lifestyle will feel unchanged.

SIPs work in the background.

They don’t announce themselves every month.

They don’t show up in your bank SMS alerts.

Expecting lifestyle change from early-stage SIPs is like expecting fitness results after a few weeks of walking.

The effort is real.

The progress exists.

But visible impact takes time.

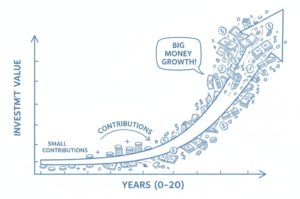

The Sachai About Compounding

Here’s the sachai most people don’t talk about.

Compounding is boring in the beginning.

For years, it feels slow.

Almost invisible.

Sometimes even disappointing.

Early on, most of the growth comes from your own contributions, not from returns.

The “magic” everyone talks about shows up much later.

But our mind wants proof now.

And life pressure wants relief today.

That mismatch creates frustration — not failure.

Why This Feeling Is Actually Normal

If you’ve ever thought:

- “Returns are good but life is the same”

- “I expected more by now”

- “Is this even worth it?”

Congratulations.

You’re a normal investor.

This phase comes before compounding becomes meaningful.

Before SIP amounts grow large enough to matter.

Before time does its heavy lifting.

Most people quit here — not because SIPs don’t work, but because patience feels unrewarded.

The Real Reason Your SIP Feels Small

Let me say this upfront — calmly.

If your SIP feels small or insignificant, it doesn’t mean you chose the wrong fund or did something wrong.

It usually means something else has been happening quietly in your life.

And most salaried Indians don’t notice it until years later.

Let’s talk about that — simply and honestly.

Your Income Grew, But Your SIP Didn’t

Think back to when you started your SIP.

Your salary was lower.

Expenses were manageable.

₹5,000 felt like a meaningful monthly commitment.

Fast forward a few years.

Your income increased.

Maybe you switched jobs.

Maybe you got regular increments.

Life moved ahead.

But the SIP?

Still ₹5,000.

What once felt significant slowly started feeling… small.

This happens automatically.

No mistake.

Just inertia.

We upgrade phones.

We upgrade lifestyles.

But SIP amounts often stay frozen — bas wahi.

Expenses Inflate Quietly

This part is dangerous because it’s silent.

No single expense shocks you.

Everything increases gradually — school fees, groceries, rent, insurance.

Month by month, your cost of living creeps up.

And because expenses get paid first, the SIP becomes what’s left over — not what’s planned.

So even if market returns are decent, the SIP struggles to keep up with the new reality of your life.

That’s when you start feeling:

“I’m investing, but it doesn’t feel powerful.”

Your SIP Isn’t Linked to a Real Goal

Most people start SIPs with good intention, but vague clarity.

“Long term ke liye.”

“Future ke liye.”

“Retirement, maybe.”

Without a clear purpose, SIP stays abstract.

You don’t really know:

- what it’s meant to achieve

- by when

- how big it actually needs to be

And anything without a destination feels small — even if it’s growing.

When SIP Becomes Background Noise

Here’s a psychological shift nobody talks about.

After a few years, SIP becomes routine.

Auto-debit.

No effort.

No emotion.

Like a subscription you barely notice.

You don’t feel pain while investing.

You don’t feel joy while it grows.

So mentally, it loses importance.

Your attention goes to salary, bonuses, expenses, EMIs.

The SIP quietly sits in the corner — doing its job, but unnoticed.

And what we don’t notice, we undervalue.

A Simple ₹ Example

Let’s keep this grounded.

Say you invest ₹5,000 per month.

You’ve been doing it consistently for years.

Your monthly expenses today might be ₹60,000–₹80,000.

Against that, ₹5,000 naturally feels tiny.

Not useless.

Just small in proportion.

Your SIP didn’t shrink.

Your life expanded.

That’s the difference most people miss.

This Is Not a SIP Problem

Let me be very clear.

This is not about:

- bad funds

- poor market returns

- wrong timing

It’s about alignment.

Income grows.

Expenses grow.

Goals evolve.

But SIPs often stay unchanged.

When these drift apart, confusion begins.

And we start questioning the tool instead of the setup.

A Calm, Honest Conclusion

If your SIP feels small, don’t panic.

It doesn’t mean it has failed.

It simply means your life has changed — and your SIP hasn’t kept pace.

That’s fixable.

Gradually.

Without stress.

SIPs are not meant to feel exciting every month.

They’re meant to quietly support future you.

And sometimes, the first step is simply understanding why something feels small —

so you can give it the importance it deserves, dheere dheere.

Compounding Works Quietly (And That’s the Problem)

Let me tell you something most finance articles don’t admit.

Compounding is not exciting.

At least, not in the beginning.

If you’re a salaried Indian running SIPs and wondering why nothing feels different despite “good returns,” this quiet nature of compounding is usually the reason.

Let’s break it down calmly — without jargon.

The Early Years Feel Boring

In the first few years of a SIP, growth feels… underwhelming.

You invest every month.

Money goes out.

Life pressure stays.

You check your portfolio occasionally and think,

“Okay, it’s growing… but slowly.”

That’s because early on, most of the money in your investment is your own contributions, not returns.

Compounding hasn’t started flexing yet.

It’s still warming up — bas.

And since there’s no visible impact on daily life, boredom slowly turns into doubt.

Why Our Mind Gets Impatient

Our brain loves instant feedback.

Salary comes every month.

Expenses show immediate results.

Even EMIs have clear end dates.

But compounding offers no such comfort.

It doesn’t send reminders saying,

“Relax, I’m working.”

So psychologically, it starts feeling unreliable — even when it isn’t.

The ₹ Example That Explains Everything

Let’s keep this simple.

Imagine you invest ₹5,000 per month through an SIP.

In the early years:

- the amount grows slowly

- gains look small

- progress feels flat

Then, much later, something shifts.

The same SIP — same effort — starts adding more value without you increasing anything.

Nothing magical happened overnight.

Time just did its job.

But because this shift is gradual, you don’t really notice it until you look back.

The Invisible Graph in Real Life

Picture a simple curve in your mind.

At first, it rises slowly — almost flat.

That’s the boring phase.

Then, in later years, it bends upward.

That’s the part people call “magic.”

Most investors lose patience before the curve bends.

Not because compounding failed —

but because waiting felt unrewarded.

The Last Few Years Do the Heavy Lifting

Here’s an uncomfortable truth.

A large part of long-term wealth is created in the last few years, not the first.

Which means:

- stopping early kills results

- judging early creates frustration

- consistency matters more than excitement

Compounding rewards people who stay invested when nothing seems to be happening.

Why This Feels Unfair

You put in effort every month.

You delay spending today.

Yet rewards show up much later.

It feels one-sided.

But this delay is exactly why compounding works.

If it felt exciting early on, everyone would stick with it.

Thoda Sa Patience Changes Everything

You don’t need blind faith.

You just need realistic expectations.

Compounding is slow.

It is silent.

And yes, it tests patience.

But it works best for people who accept its boring phase without constantly second-guessing themselves.

A Quiet, Reassuring Conclusion

If your SIP feels unimpressive right now, that’s normal.

Nothing is broken.

Nothing needs urgent fixing.

You’re likely still in the quiet phase — where effort is visible, but results aren’t.

Stay consistent.

Stay calm.

Give time the respect it deserves.

One day, you’ll look back and realize:

the silence wasn’t absence of progress —

it was compounding at work, dheere dheere.

What Actually Makes an SIP Feel Powerful

Most people think an SIP becomes powerful because of a great fund or perfect timing.

That’s not true.

An SIP starts feeling powerful only when your behaviour around it changes.

Quietly. Gradually. Without drama.

Let me explain this the way I’d explain it to a fellow salaried professional — no hype, no long checklist.

Power Comes From Small Behavioural Shifts

Big changes rarely stick.

What works are small shifts you barely notice:

- treating the SIP as non-negotiable

- not stopping it during temporary market noise

- not touching it just because one month feels expensive

These actions aren’t exciting.

But they create stability.

And stability is what allows money to grow without stress — bas.

Why Calm Beats Excitement

An SIP that feels powerful doesn’t make you excited.

It makes you calm.

You don’t check it daily.

You don’t react to headlines.

You don’t feel the urge to “do something.”

That quiet sense of control — knowing things are running in the background — is far more valuable than chasing fast results.

If your SIP reduces mental load, it’s already doing part of its job.

The One ₹ Example That Actually Matters

Let’s keep this practical.

You start with a ₹5,000 SIP.

Every time your salary increases — even slightly — you increase this SIP a little.

Not aggressively.

Not suddenly.

Just steadily.

Over time, the SIP begins to match your life stage.

It grows with you, not behind you.

That’s when it stops feeling small.

Why Behaviour Matters More Than Returns

Market returns are not fully in your control.

Your behaviour is.

When your SIP grows along with your income, two things happen:

- You start respecting your future self more

- Your investment feels relevant to your current life

This single habit often matters more than finding the “best” fund.

Goal-Based Thinking Creates Meaning

A single SIP with no clear purpose feels abstract.

But when you mentally connect it to outcomes:

- future security

- flexibility

- peace of mind

the relationship changes.

You’re no longer investing for “someday.”

You’re investing for specific versions of your future.

And money with meaning always feels more powerful.

Time + Consistency Do the Heavy Lifting

This part isn’t exciting, but it’s essential.

SIPs don’t feel powerful in year two or three.

They start feeling powerful much later — after you’ve stayed consistent through:

- market ups and downs

- job changes

- life expenses

Time rewards people who don’t overreact.

And consistency quietly compounds — not just money, but confidence.

Track Progress, Not Noise

One small mental shift helps a lot.

Stop watching daily fund prices.

Start reviewing overall progress once in a while.

Not to judge.

Just to stay aware.

When you look at the combined journey instead of daily movement, the SIP feels less random and more intentional — samajh aa jata hai.

A Quiet, Grounded Conclusion

An SIP doesn’t feel powerful because it grows fast.

It feels powerful because:

- you trust it

- you adjust it as life changes

- you don’t panic around it

There’s no magic switch.

Just steady alignment between income, goals, and behaviour.

If your SIP feels boring but consistent, you’re on the right path.

In personal finance, real power is rarely loud.

It’s quiet.

And it shows up exactly when you need it — over time.

A Simple Shift That Changes Everything

Most salaried Indians look at their SIP the same way they look at an electricity bill.

A monthly deduction.

Money that goes out quietly.

No emotion attached.

And that’s exactly why it doesn’t feel powerful.

Let me share one simple shift that changes how SIPs feel—without adding pressure, complexity, or extra effort.

From ‘Monthly Deduction’ to ‘Wealth Engine’

Right now, your SIP probably feels like money leaving your account.

Auto-debit happens.

You barely notice.

Life continues.

But an SIP is not an expense.

It’s a wealth engine running in the background.

But an SIP is not an

expense

It’s a wealth engine

running in the background.

Expenses disappear after payment.

SIPs don’t.

This shift—from “cut from salary” to “engine for future me”—changes how seriously your mind treats it.

Bas yahin se farq padta hai.

Why Daily Tracking Kills Motivation

Checking SIPs daily does more harm than good.

Markets move.

Numbers fluctuate.

Your mood swings for no real reason.

But SIPs are not meant to be tracked daily.

They’re meant to be reviewed occasionally.

Once a year is enough.

That distance creates clarity.

And clarity brings confidence.

The ₹ Example That Explains the Shift

Suppose you invest ₹5,000 per month.

If you think of it as:

- “Money deducted every month” → it feels painful

If you think of it as:

- “A system quietly building future options” → it feels reassuring

Same amount.

Same action.

Only the lens changes.

And that lens decides whether you feel frustrated or peaceful.

Small, Intentional Changes Matter

This shift doesn’t require dramatic action.

No sudden jumps.

No aggressive planning.

Just small intent:

- Increase SIP slightly when salary increases

- Don’t pause it for short-term discomfort

- Let it run without emotional interference

These are not big decisions.

They’re calm decisions.

And calm decisions compound better than impulsive ones.

Reframe SIP as a System, Not a Deduction

A deduction feels like loss.

A system feels like progress.

Your SIP is a system that:

- Works every month

- Doesn’t demand attention

- Adjusts slowly with your life

Once you see it this way, impatience reduces.

You stop asking, “Is this working?”

And start trusting the process.

The One Mindset Shift That Changes Everything

Stop expecting your SIP to improve your present.

Its job is to protect your future.

When you stop judging it by today’s lifestyle and start respecting it as a long-term system, frustration fades.

Pressure goes down.

Confidence goes up.

A Soft, Reassuring Conclusion

If your SIP feels underwhelming right now, don’t push yourself.

No urgency.

No guilt.

No comparison.

Just gently shift how you see it.

From a monthly deduction

to a quiet wealth engine.

That one mental reframe reduces stress, builds patience, and lets compounding do its work—dheere dheere.

Sometimes, nothing needs to change except how you look at it.

Final Thoughts from Me

Keep Investment Simple without noise. Listen to everyone but don’t get carried away and jump into an invest without research.